The TUC has criticised a new push by insurers and the government to limit access to compensation for workers injured as a result of accidents at their place of work, in a move that shows that big business and insurance companies determine government policy on workplace health and safety.

Axa chief Paul Evans told the Daily Telegraph on 4 August that “compensation culture is becoming a real issue for society”, adding: “We are seeing more claims for stress coming through, and deafness or loss of hearing through noise in the workplace, more claims on employer liability. Again like whiplash these are things that at the time are nearly impossible to prove.”

But, in reality, noise-induced deafness is extremely easy to prove, using a simple diagnostic audiometric test.

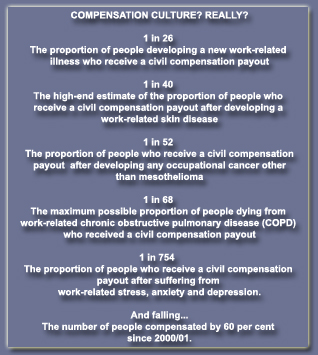

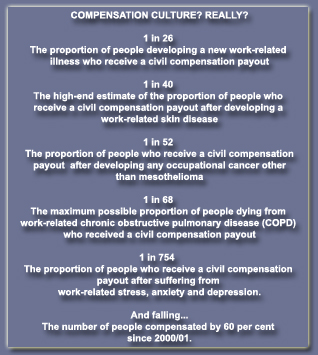

Further still, a TUC-backed Hazards report last week revealed fewer than 1 in every 750 workers suffering from health problems related to stress at work get a payout.

Further still, a TUC-backed Hazards report last week revealed fewer than 1 in every 750 workers suffering from health problems related to stress at work get a payout.

The report says ministers have cynically exaggerated vexatious claims in order to introduce a series of policies that make it harder for victims to seek compensation.

The TUC point out that since coming to power the government has slashed the coverage and budget of the Criminal Injuries Compensation Scheme, and outlawed strict liability claims where there has been a criminal breach of safety law by the employer but negligence hasn't been proven.

In addition, ministers have cut the number of workplace inspections carried out by the Health and Safety Executive (HSE).

A series of government measures are also creating costly barriers stopping many of those injured or made ill by their jobs from seeking compensation through the courts, says the report.

For example in May 2013, the no-win, no-fee conditional fee arrangements, introduced after legal aid was abolished for personal injury claims, were tweaked so victims now give an unhealthy slice - up to 25 per cent - of any payout to the lawyers.

On 31 July, the government introduced a system to channel employers' liability claims worth less than £25,000 through a 'claims portal', a move it says is intended to 'reduce the amount defendants, or their insurers, have to pay in legal fees.'

It does this by reducing payments to claimants' lawyers, meaning it will be difficult to get law firms to take on all but the most straightforward claims.

Justice minister Helen Grant said:

'We are turning the tide on the compensation culture which has pushed up the cost of insurance for drivers, schools and business - and taking another important step to reducing the cost of living for ordinary people.'

Thompsons Solicitors issued a press release debunking that myth!

They provide the reality, as opposed to the ‘untruths’ spinned out by the Government and refer to the Hazards report released on 1st August exposing the Government’s scaremongering about an ‘escalating compensation culture’ as a myth.

The report shows work injury claims are down 60 per cent in the last decade, from 219,183 in 2000/01 to 87,655 in 2011/12 - despite the Government’s message that ‘trivial’ claims are rife.

The report shows work injury claims are down 60 per cent in the last decade, from 219,183 in 2000/01 to 87,655 in 2011/12 - despite the Government’s message that ‘trivial’ claims are rife.

Less than one in 50 occupational cancer victims receive payouts, say Thompsons.

Official Government figures reveal a reduction in payouts across the board. Less than one in 50 occupational cancer victims receive payouts, and while more than 4,000 workers die of chronic bronchitis and emphysema each year, a mere 59 received compensation in 2011/12.

“This report reveals how disconnected the Government is. Banging on about a so called ‘compensation culture' may keep their friends in the insurance industry happy but it bears no relation to the hard statistical evidence.” said Tom Jones, Head of Policy and Public Affairs at Thompsons.

“At Thompsons we deal with thousands of cases each year where individuals have had their lives ruined, or families have lost loved ones due to basic health and safety errors.

Employers have a responsibility to ensure that their workers are given the basic protections afforded them by law. The government's role is not to downplay health and safety by going on about 'red tape' as that only encourages poor employers to cut corners to save money.”

Commenting on the clampdown on workplace claims, TUC's Hugh Robertson said:

"There is not one single shred of evidence that there is any kind of compensation culture. The number of claims has fallen by 60 per cent in the past decade and only a small percentage of injured and ill workers even make a claim."

He added:

"The government, at the behest of the insurance industry, is trying to stop workers getting justice by making it even harder to claim with changes to the way costs are worked out and removing employers' liability when they break the law.

While workers face reduced protection in the workplace and cuts to their compensation when they do get injured (if they are ever able to claim), the government will continue their 'blame the victim' blitz egged on by their cheerleaders in the insurance industry."

Hazards Editor Rory O'Neill, Professor of Occupational Health at Stirling University and the author of the report, said:

"The government's cynical promotion of a compensation culture myth means many workers who are dying in pain are also dying in poverty. We are seeing a denial of justice because the government is putting the health of the insurance industry and the safety of the most dangerous rogues in the business community over the health, safety and survival of people at work."

You can read the Hazards full report here

Source: Thompsons Solicitors / Hazards / TUC

The report shows work injury claims are down 60 per cent in the last decade, from 219,183 in 2000/01 to 87,655 in 2011/12 - despite the Government’s message that ‘trivial’ claims are rife.

The report shows work injury claims are down 60 per cent in the last decade, from 219,183 in 2000/01 to 87,655 in 2011/12 - despite the Government’s message that ‘trivial’ claims are rife.